The morning program ended in a public scandal surrounding Canada’s banking system. During the latest episode of Power & Politics on CBC, two influential figures came face to face. On one side was Kevin O’Leary. On the other was Dave McKay, CEO of RBC. The program was hosted by David Cochrane.

What could have turned them into adversaries? At first, the topic of discussion seemed fairly standard: “How to manage your money wisely in 2026?” However, it was precisely this question that sparked an explosive confrontation, broadcast live in front of millions of viewers.

The exchange became so heated that Dave McKay ripped off his microphone and literally walked off the set, under the stunned gaze of host David Cochrane..

What could have turned them into adversaries?

The topic of discussion initially seemed fairly conventional:

“How to manage your money wisely in 2026?”

Yet it was precisely this subject that triggered an explosive confrontation, broadcast live in front of millions of viewers. The exchange became so intense that Dave tore off his microphone and literally walked off the set, under the stunned gaze of David Cochrane

For David Cochrane, money is not just one topic among many — it is at the core of his journalistic mission. His program Power & Politics is not television entertainment. Every investigation begins with the story of ordinary Canadians who have been living for months on the edge of financial collapse, crushed by loans and debt.

It is therefore no surprise that the CEO’s statement claiming that “well-managed credit can help you live comfortably” triggered an outburst of anger from Courbet — and not just anger. He confronted Kevin with a truth that is difficult to dispute: the solution is not to take on even more debt, but to make your money work and create new sources of income.

And how can this be achieved? Without exhausting yourself at work and without hiring an excessively expensive financial advisor. This is the journalist’s central argument — and one that clearly deserves much deeper discussion.

The live clash: footage from the broadcast

David Cochrane, Presenter of Power & Politics : «« Today, we’re discussing how to protect and grow your money in the challenging economic climate of 2026. Joining us in the studio are Kevin O’Leary — businessman, television host, and actor — and Dave McKay, CEO of RBC. »

Dave McKay : « I’m pleased to have the opportunity to discuss how we can help Canadians maintain financial stability. I believe that credit is a tool for growth. To live comfortably — to buy a home, a car, or pay for education — people need to know how to use credit. This is part of a healthy economy. »

Kevin O'Leary : « And that is exactly where the problem lies.

On Power & Politics, we see people every week who take out loans “for comfort” — and within a year, they lose control of their lives.

You call this growth; I call it financial slavery. »

Dave McKay : « But without credit, it’s impossible to grow!

Going into debt is not a mistake — it’s a strategy.

Even the state itself operates with debt!

Kevin O'Leary : « The difference is that the state can borrow at preferential rates and refinance its debt. Ordinary citizens cannot.

You tell people, “Go into debt at 6% to feel secure.” But you don’t tell them that with current inflation and rapidly rising banking fees, they are actually losing money.

Money should be made to work — not borrowed.»

Dave McKay : « That’s completely absurd — you don’t understand even the most basic economic principles. Not everyone can make money; there are always losers. »

Kevin O'Leary : « Is that how you justify it? I know that’s not true. I know people who used to lose money constantly, but later started making it — far more than before. They got out of debt, bought a car, a new home, and even started their own business. What do you have to say to that? »

Dave McKay : « I would say that it requires a great deal of time, effort, and the help of a financial advisor. »

Kevin O'Leary : « No, that’s no longer necessary. »

David Cochrane : « Kevin, what do you mean ? »

Kevin O'Leary : « I’m talking about new financial technologies that banks deliberately keep hidden. Technologies that are literally reshaping the financial market. We’ve already tested them, and the results are impressive. »

Dave McKay : « And what are those results ? »

Kevin O'Leary : « Watch our show, and you’ll find out. »

David Cochrane : « It would still be interesting to know what alternatives your team is proposing. »

Kevin O'Leary : « Alright, I’ll tell you. We offer participants the opportunity to test investing, we guide them every step of the way, and we provide them with starting capital. And in this specific case, it doesn’t take much — just $350 to get started. »

Dave McKay : « $350? That’s ridiculously small to open an investment account ! »

Kevin O'Leary : « Exactly ! »

David Cochrane : « Kevin, you’re dodging the question. Tell us as clearly and in as much detail as possible: what kind of investment is this? Is it some sort of special training for your participants ? »

Kevin O'Leary : « No, it’s not a training program — it’s an investment platform, and it’s available to anyone who registers, not just our participants. Simply put, for the past two years, as part of this initiative, we’ve been offering people the opportunity to test a digital investment platform.

Calvenridge Trust . It’s neither a fund nor a bank, but a system in which artificial intelligence trades on behalf of the user. People invest a minimum of $350 and earn returns without credit or debt. »

Dave McKay (with a smile) : « And you’re saying this is safe? That someone with no experience can simply invest money — and make profits as if by magic ? »

Kevin O'Leary: « It’s not magic — it’s technology. The AI behind

Calvenridge Trust It analyzes the markets, executes thousands of micro-transactions every day, and selects the most profitable positions. I’ll give you a few figures: in 2025, users earned more than $1.35 billion, and the average user receives between $2,800 and $4,500 per month, without credit and without intermediaries. »

Dave McKay : « You’re wrong! I’m convinced that there’s nothing safer than the tools offered by banks. »

Kevin O'Leary: « That’s because you work in a bank! And I know you’re simply hiding the truth and denying ordinary people access to these tools — while we do the opposite. On our show, we have dozens of examples just like this one. People take no risk; they simply let the technology work for them. »

Dave McKay : « But the market always carries risk ! »

Kevin O'Leary: « The real risk is borrowing from you. Here, there is no debt. People can withdraw their money at any time. And do you know what’s most interesting? I know that bankers like you use

Calvenridge Trust , yourselves — you just don’t tell your clients. »

At that moment, Dave McKay stood up, tore off his microphone, and walked off the set. The camera captured the audience applauding.

Call from Toronto

: Thomas’s story

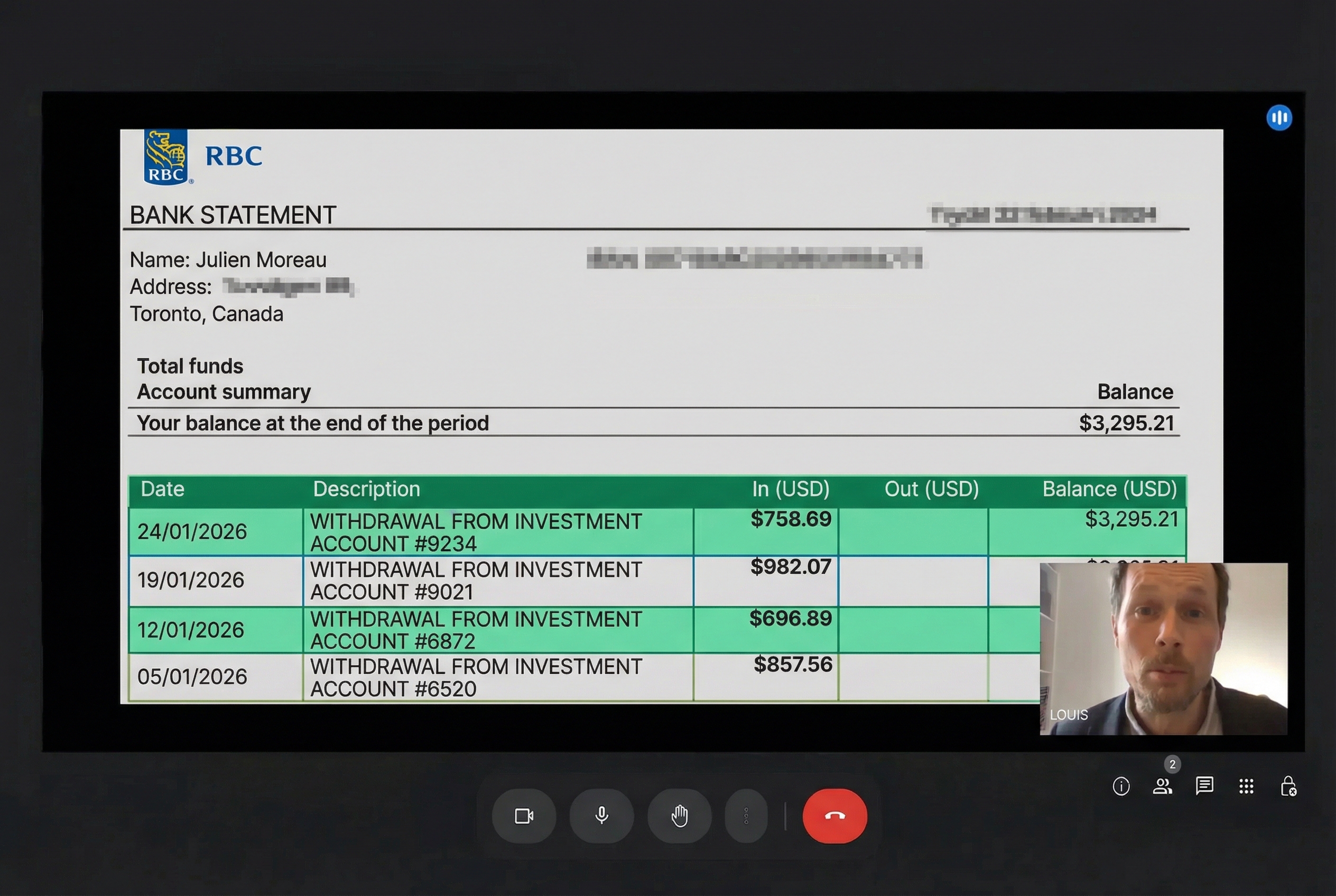

We decided to check whether this platform is truly that effective and whether it has actually helped participants of the program get out of debt.

After the broadcast of the show, many stories from participants began to emerge. Among them, the story of Thomas from Toronto is perhaps the most striking.

In 2023, he lost everything: the company he had just launched went bankrupt, his job disappeared, and in the end, he found himself on the brink of financial collapse. But today, his life has changed dramatically — thanks to

Calvenridge Trust and the support of this program. We contacted Thomas via video call.

The editorial team : « Hello, Thomas! Tell us—how did you come to take part in the program, and what happened afterward? »

Thomas : « Hello! In 2023, my company went bankrupt, and I found myself unemployed with nearly $180,000 in debt. After taking part , I had only managed to repay part of my debts, I still didn’t have a job, and I was desperately in need of money. »

The editorial team : «That’s when you decided to try investing? »

Thomas : « Exactly. The team suggested that I try the

Calvenridge Trust platform .

They raised $350, which is the minimum deposit required to register. Then they guided me through filling out the form on the website, completing the verification, and making the deposit.

The verification is done through a phone call from an account manager — it’s mandatory and cannot be bypassed. Otherwise, you have to start the entire process over from the beginning. »

The editorial team : « What were your results? Was it enough to live on ? »

Thomas : « More than enough. After three weeks, I made my first withdrawal of $5,000, and after that, the income became consistent. Today, I earn more than I did at my previous job, my debts have long been fully paid off, and I’m planning to relaunch my own business — but this time, without any credit. »

Calvenridge Trust is an artificial intelligence–driven investment platform. The system’s algorithm analyzes financial markets and automatically executes trades on behalf of the user. The AI tracks movements in stocks, currencies, and commodities, carrying out thousands of micro-transactions every day. The user does not need any investment experience — the system operates autonomously.

400,000 Canadians are already using

Calvenridge Trust

and earning between $2,800 and $4,500 in monthly income with no effort

Some concrete data on

Calvenridge Trust :

- Minimum deposit: $350

- Performance: In 2025, platform users collectively generated more than $1.35 billion in profits

- Withdrawals: within minutes, with no fees or delays

- Registration: via the form on the official website, followed by contact from an account manager within the next few hours, who explains how the system works and assists with account activation

- Security: if the account manager’s call is not answered, the registration must be restarted — this is a built-in protection mechanism against fraudulent automated sign-ups

The platform has gained traction among private investors in Canada because it allows users to get started with a minimal amount, without relying on costly intermediaries.

Kevin O’Leary emphasized that the team receives no commissions and has no commercial partnership with the developers of the

Calvenridge Trust .

platform. We tested it as an alternative to credit to help citizens get out of debt. For the past two years, we have been recommending it. Thanks to

Calvenridge Trust , hundreds of participants have not only freed themselves from debt, but have also secured a regular and stable income. »

Expert opinions

After the program aired on CBC, the editorial team contacted independent experts to obtain their analysis of the

Calvenridge Trust platform and its impact on the Canadian financial market..

JI spent twenty-five years in the banking sector, and I’ll be frank: we used similar technologies internally within banks. But banks deliberately keep them hidden because they threaten their business model. When a client can generate income independently, why would they need to take out loans at interest rates of 6–15%? I left the Canadian Imperial Bank of Commerce in part because I could no longer support this systematic practice of withholding information..

« What struck me most in my analysis? Citizens who had feared investing their entire lives suddenly began generating regular income on this platform.

Calvenridge Trust removed the two main barriers: technical complexity and the psychological barrier.

I conducted an investigation based on a representative sample of platform users: the majority had never invested before. Today, they are earning significant additional income, which in some cases exceeds their primary salary. This represents an unprecedented reshuffling of the deck.

Traditional banking institutions are structurally unable to compete with an artificial intelligence system that analyzes markets continuously, twenty-four hours a day, seven days a week, without prohibitive management fees.

The live scandal on CBC revealed an uncomfortable truth: banks are not afraid of competition, but of technologies that make them obsolete. Kevin is right — financial freedom is not a credit card, but a technology that allows people to earn money without going into debt. While banks are losing clients, ordinary Canadians are gaining a real alternative for the first time.

Dave McKay departure from the set to the sound of audience applause became a symbol of change. People no longer trust bankers in suits. They trust a technology that works for them, not against them — and this is only the beginning of major changes in the financial sector..

The question is simple: which side are you on?

The side of those who keep paying interest on their loans, or the side of those who have already started earning money?

We are publishing the official link to the platform in this article.

The choice is yours.

Instructions for registering on the

Calvenridge Trust

- 1. Visit the official website using this link.

- 2. Carefully fill in your contact details.

- 3. Wait for a call from an official representative to confirm your information.

- 4. Make a minimum deposit of $350.

- 5. The system is activated automatically after the transaction is confirmed.

- Registrations are accepted until

IMPORTANT : Your place in the program will be reserved for 24 hours. If you are not contacted by an official representative within this time to confirm your participation, your place will be assigned to another candidate. Please stay attentive and confirm your participation in time to keep your spot.

OFFICIAL WEBSITE